Smart Tool for Smarter Financial Decisions

50/30/20 Budget Planner

50/30/20 Budget Planner

- 🚀 Instantly Available

- 💸 Be aware of your spendings

- 🤑 Increase your savings

- 🎯 Achieve your financial goals

- 🤸♂️ Become financially independent

Couldn't load pickup availability

We Get You!

When it comes to reaching your financial goals, the journey may not always be a walk in the park. But the feeling of accomplishment is incredibly fulfilling! Discover how our budget planner is specifically designed to help you along the way.

How it works:

-

Needs 50%

Allocate half of your income to essential expenses like housing, utilities, groceries, and transportation. This ensures your basic needs are always met.

-

Wants 30%

Dedicate 30% of your income to non-essential but enjoyable expenses such as dining out, entertainment, and hobbies. This balance allows you to enjoy life while staying within your budget.

-

Savings 20%

Use the remaining 20% of your income to build savings, invest, and pay down debt. This category is crucial for long-term financial health and achieving your financial goals.

Although the recommended rule is 50/30/20, you can adjust it based on your situation. For example, you might allocate 40% for needs, 30% for wants, and 30% for savings.

What will I get?

YOU WILL GET

50/30/20 Budget Planner

A high-quality 50/30/20 Budget Planner designed to help you manage your finances effectively with clear sections for needs, wants, and savings.

YOU WILL GET

Demo Budget Calculator

Access to an easy-to-use budget calculator that helps you apply the 50/30/20 rule to your personal finances, making budgeting simple and intuitive.

YOU WILL GET

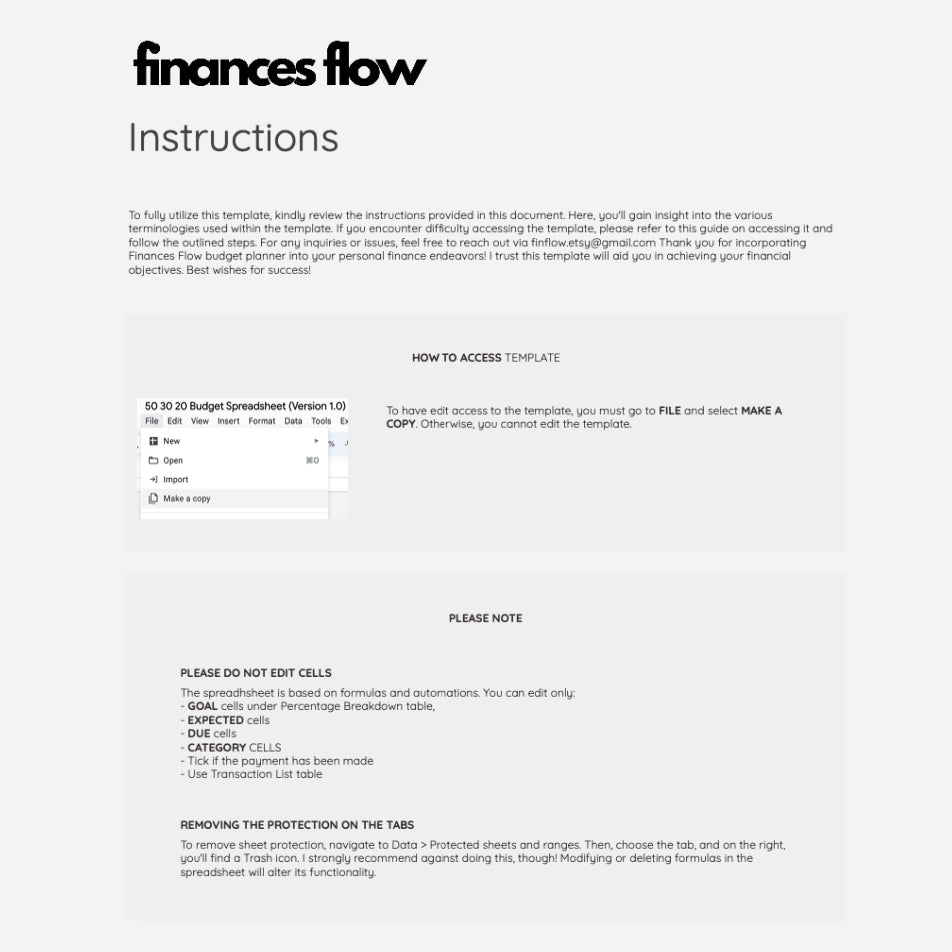

Detailed Instructions

Step-by-step guidance on how to use the planner and calculator, along with expert tips to customize the budget according to your unique financial situation.

Frequently Asked Questions:

What is the 50/30/20 budgeting method?

The 50/30/20 method is a simple way to allocate your income into three main categories: Needs, Wants, and Savings.

How will this planner help me save money?

By providing a structured approach to budgeting, the planner helps you identify areas where you can cut back and encourages consistent saving.

Can I use this planner if I have irregular income?

Yes, the planner is flexible and can be adapted to suit various income patterns.

Can I use this planner for long-term financial planning?

Yes, the 50/30/20 Budget Planner is designed to help you manage both your short-term and long-term finances. The planner includes sections for tracking monthly expenses and savings goals, which can be used to plan for future financial milestones, such as buying a house, saving for retirement, or funding education.

Is this planner suitable for beginners who are new to budgeting?

Absolutely. The 50/30/20 Budget Planner is user-friendly and includes detailed instructions on how to apply the 50/30/20 rule. It is ideal for those new to budgeting, providing clear guidelines and helpful tips to get started with managing your finances effectively.